Ema Trading Strategy

Now, i want to start off by saying that this setup doesn’t happen often but when it does, it works really well. For this strategy, we are going to use the 20 ema and 50 ema.

Volume Weighted EMA Forex Trading Strategy Free Download

Volume Weighted EMA Forex Trading Strategy Free Download

The setup also works for any time frame.

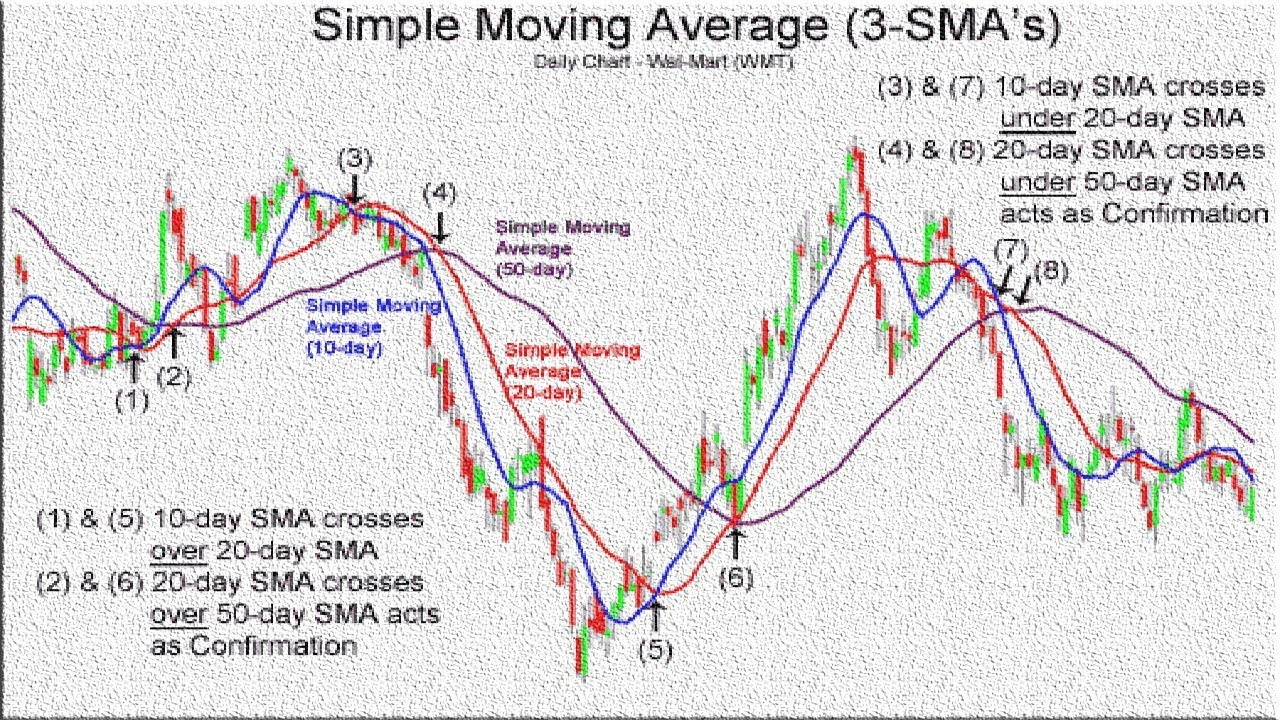

Ema trading strategy. Using ema crossovers as a buy/sell indicator when considering strategy, a trader might use crossovers of the 50 ema by the 10 or 20 ema as trading signals. There are no trading strategies that will generate a profit every single time, but there are some really basic strategies that can produce some pretty good results. Throughout this ema trading guide, we’re going to reveal some unconventional ema techniques that can dramatically improve your trading outcomes.

In this strategy, we do not wait for the moving averages to tell us when to buy or when to sell. If the exponential moving average strategy works on any type of market, they work for any time frame. We only want to take long trades when the 20 ema is above the 50 ema.

To clarify, old data points retain a multiplier (albeit declining to almost nothing) even if they are outside of the selected data series length. This ema stock trading strategy uses 2 emas with the same period. The chart below shows the three period and five period exponential moving average applied to the daily chart of gold.

This means you can trade using this strategy on your preferred chart. The 9 and 30 moving average strategy is a versatile trading strategy that can be used in ways you never thought possible. 17 dec 2020 finding the right trading strategy that suits your style can be tough, but using an ema crossover strategy can be extremely effective in helping you to become a profitable technical analysis based trader.

This strategy is a combination of two specific emas, one with a period of 12 days and another with 26 days. The trading rules will be the same regardless. There are many ways to trade with the ema.

With the 200 ema trading strategy you are trading with the trend and are hopefully buying low, selling high, and at times catching a major move in the market carrying you into a very large swing trade. The 200 ema acts as a filter in that you will only look to take buy trades when price is above the 200 ema line. Ema 12 and ema 26 trading strategies.

Therefore, the exponential moving average reacts much faster to price dynamics and offers a more accurate representation of trends compared to the sma and wma. While you can use the exponential moving average in many ways, professional traders stick to keeping things simple. The 50 ema forex trading strategy is one trading strategy that is so simple that you can use to trade using any currency pair in any pair time frame.

It all depends on your preferred time frame. Or you will only look to take sell trades when the price is below the 200 ema line. For trade entries, you are going to use price action.click here for my free price action trading course

The strategy is simple, we take 2 exponential moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs. The ema (5) and ema (20) crossover trading strategy. The 50 ema bounce trading strategy.

An example has been provided below for a buy trade in a bullish market. The blue line is the 5 ema and the black line is the 8 ema. Ema trading or exponential moving average based trading is a strategy that involves using the exponential moving average indicator.

Ema trend trading getting started. You may have success using this strategy on as low as the one hour chart or as high as the daily chart; Forex trading strategy & education.

Ema period 5 (green line in the. One of the most popular and commonly used indicators and strategies is the moving average and in particular the 200 ema trading strategy. Whilst this is a longer term indicator, it can be extremely useful for finding trends, placing and managing trades and using it with other ema’s in a crossover strategy.

Another strategy that forex traders use. This strategy consists of four indicators, which are: Using the exponential moving average (ema) can enhance almost any trading strategy.

For example, you can simple combine two periods of exponential moving averages on the charts. This is a price action trading system that uses 20 ema and it is called the 20 ema bounce forex trading strategy and it is a really simple trading system even a completely new forex trader can follow easily. An exponential moving average (ema) is a type of moving average that places a greater weight and significance on the most recent data points.

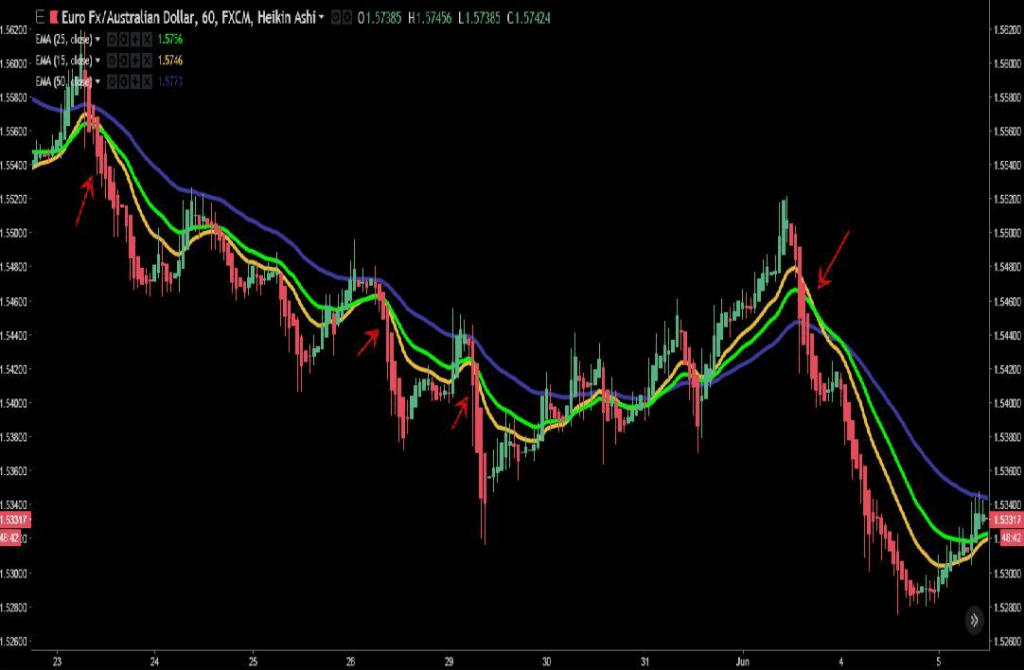

One commonly used ema crossover strategy is the ema 12 and ema 26. From forex to bitcoin, the triple ema strategy works on any time frame. This 200 ema and 15 ema crossover trading strategy is a trend trading system that uses two exponetial moving averages, the 200 ema and the 15 ema.

An exponential moving average (ema) is very similar to (and is a type of) a weighted moving average. Ema is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. Crossover strategy tutorial & review updated:

Basically moving average shows traders’ sentiment. The only forex indicator you need is the 20 exponential moving average. This trading strategy relies heavily on catching the trend.

The exponential moving average ema strategy is a universal trading strategy that works in all markets. The 200 ema trading strategy is a very simple and really easy to follow forex trading strategy that you will find really appealing and has the potential to bring your hundreds of pips a month. [3] trading with the exponential moving average.

The 3 ema crossover trading strategy uses the trend properties of moving averages for trade entry and pullbacks. It is widely popular amongst forex trading. The major difference with the ema is that old data points never leave the average.

You can substtitue 50 exponential moving average with other ema’s like 10, 20, 30.

High Profits Advanced Forex Smoothed Moving Average (SMMA

High Profits Advanced Forex Smoothed Moving Average (SMMA

Support and Resistance support and resistance trading

Support and Resistance support and resistance trading

EMA Trading strategy with RSI & parabolic SAR indicator by

EMA Trading strategy with RSI & parabolic SAR indicator by

The Complete EMA Trading Strategy Market Geeks Market

The Complete EMA Trading Strategy Market Geeks Market

200 Pips al dia con la Estrategia de 3 EMAs Traders Unidos

EMA TRADING STRATEGY TUTORIAL! 2020 YouTube

EMA TRADING STRATEGY TUTORIAL! 2020 YouTube

The 15 min Triple EMA Forex Trading Strategy ForexCracked

The 15 min Triple EMA Forex Trading Strategy ForexCracked

Forex Trading Strategy with OsMA and EMA on 5 min chart.

Forex Trading Strategy with OsMA and EMA on 5 min chart.

Forex Trading strategy with EMA for a Strong Trend Forex

Forex Trading strategy with EMA for a Strong Trend Forex

QQE and 100 EMA Forex Trading Strategy Free Download

QQE and 100 EMA Forex Trading Strategy Free Download

Exponential Moving Average 5 Simple Trading Strategies

Exponential Moving Average 5 Simple Trading Strategies

Forex 20 Ema Strategies Forex Early Warning Trading

Forex 20 Ema Strategies Forex Early Warning Trading

50 EMA Forex Trading StrategyThe Trading Rules Are Really

50 EMA Forex Trading StrategyThe Trading Rules Are Really

Best Exponential Moving Average (EMA) Trading Strategy for

Best Exponential Moving Average (EMA) Trading Strategy for

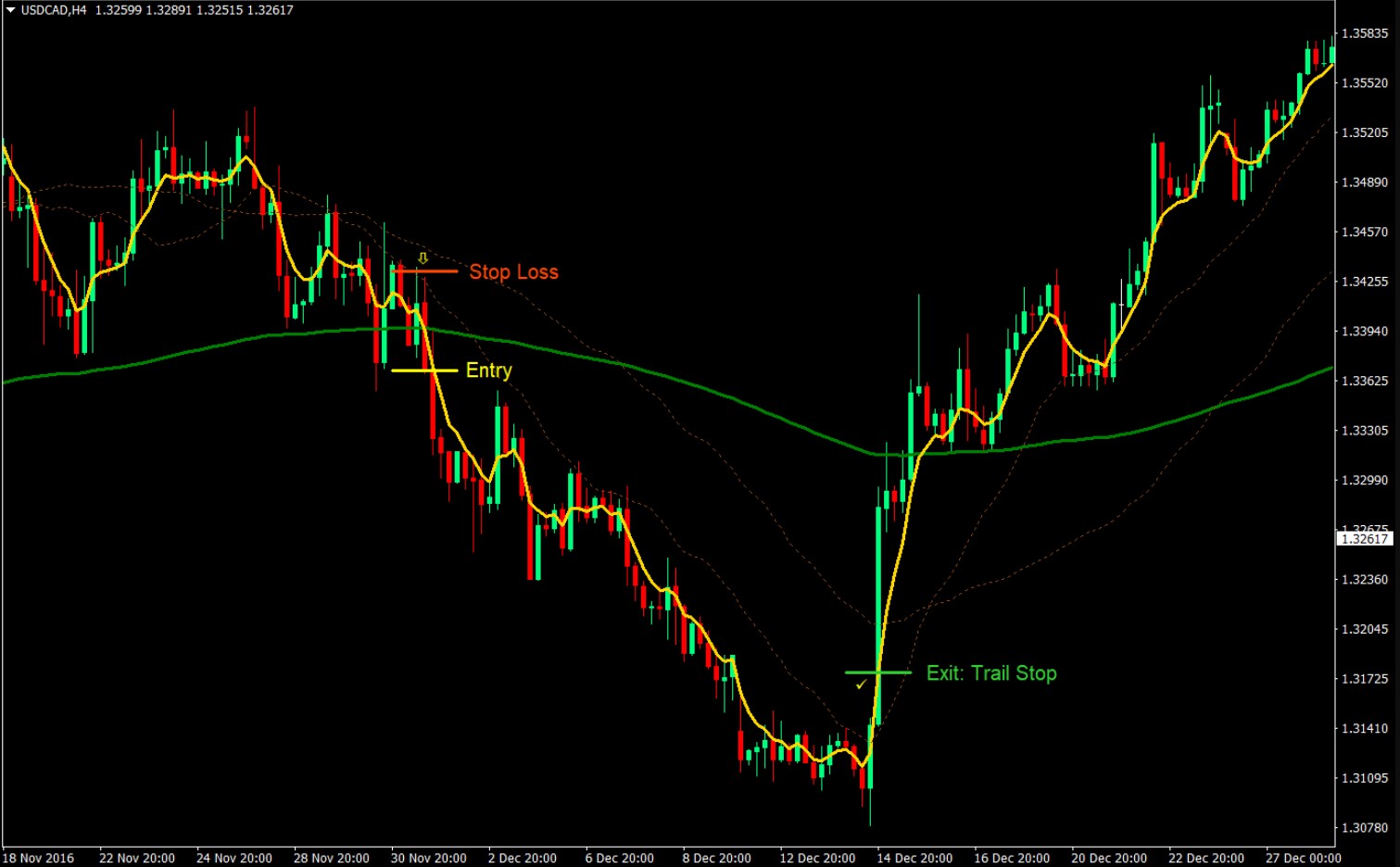

The 3 Step EMA Strategy for Forex Trends

Part 1a 9/20 EMA Strategy Explained YouTube

Part 1a 9/20 EMA Strategy Explained YouTube

Combine EMA Cross And A Pattern For Swing or Medium Term

Combine EMA Cross And A Pattern For Swing or Medium Term

EMA Trading System Forex Winners Free DownloadForex

Forex Trading Strategy with EMA(5), EMA(12) and RSI(21

Forex Trading Strategy with EMA(5), EMA(12) and RSI(21

No comments: