What Is Future Trading

Because it is a function. The asset transacted is usually a commodity or financial instrument.

The Futures Trading Strategies to Use (and the ones to

The Futures Trading Strategies to Use (and the ones to

What are futures and options?

What is future trading. In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. Future trading., is a specialized trading company that commenced its trading activities in chemical products and over the years has diversified into plastic raw materials, and bulk products such as cement, cement clinker, micro silica, fly ash & soda ash. The past performance of any trading system or methodology is not necessarily indicative of future results.

Chuck kowalski is an expert on trading strategies and commodities for the balance. Read all about future trading and contract. There's a new commodity in town for investors to trade:

696 likes · 1 talking about this · 16 were here. He has more than 20 years of experience in the futures markets as a trader, analyst, and broker, and has written market commentary for seekingaplha.com, talkmarkets.com, and more. Futures trading involves trading in contracts in the derivatives markets.

The findings in the series come from an online survey of 107 capital market professionals working globally, and are analyzed by firm type, region and generation. Tradingcharts is the leading source for free futures and commodity prices / quotes and charts, and other market information including futures and commodity news.tradingcharts tracks many commodities and financial indicators, making the information available in the form of free commodity charts and intraday commodity quotes. You will learn about futures, stocks and cryptocurrencies trading.

Start your journey in futures trading with kotak securities today! A future is a right and an obligation to buy or sell an underlying stock (or other assets) at a predetermined price and deliverable at. Future trading agencies is a multifunctional company registered in malaysia.

Our goal at marine future trading group is to create and automate strategies. However, one of our main activities is the organization of international sports tournaments, which provide innovative entertainment opportunities that can be used to promote interactive boxing and other sports. Hello guys, first we have to know some basic points of future and options trading.

Futures trading is especially common with commodities. The future trading has an expiry date that generally is on the last thursday of every month where this month’s contracts are expired and next month’s contracts are in force. Futures trading history is as simple as understanding the concept of farmers planting crops every spring, and then, every fall, farmers harvesting grain and locking in prices early in the season.

This module covers the various intricacies involved in undergoing a futures trade module 4 Future contracts can be on stocks, indices, commodities or even currencies. A holds the view that the value of a stock would rise from its present value in the future while b believes the opposite.

To illustrate, consider two trading entities a and b. A and b enter into a contract with a agreeing to buy shares of the stock from b at the present price sometime in the future. He is a graduate of florida state university.

Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price. Coverage of premarket trading, including futures information for the s&p 500, nasdaq composite and dow jones industrial average. An adjustable feature may include such features as sliding.

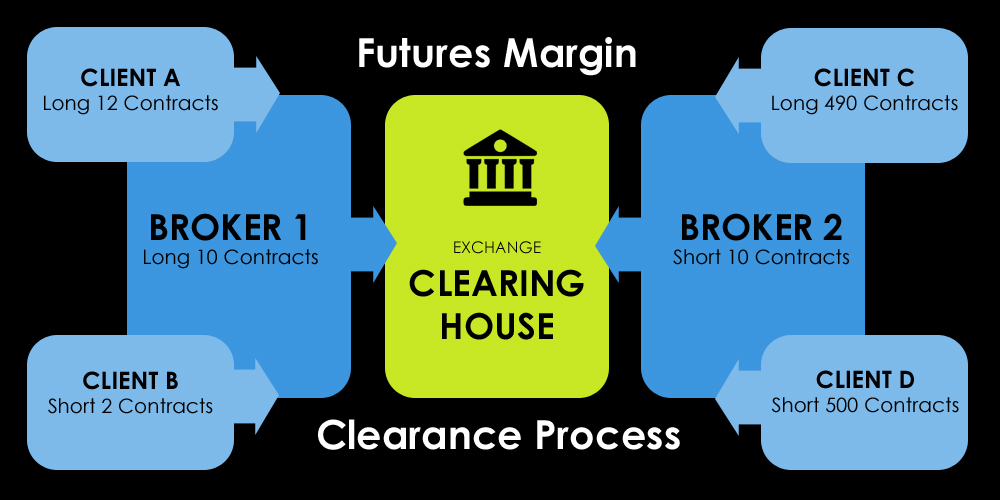

In futures trading, you pay the margin upfront, held in an escrow account. You will get to know many important platforms for future trading!. Trading codes empowering how you manage ether risk exposure expand your choices for managing cryptocurrency risk with new cme ether futures developed by the leading, most diverse, and regulated derivatives marketplace, home to bitcoin futures and options.

For the avoidance of any doubt, backtothefuturetrading.com and any associated companies, or employees, do not hold themselves out as commodity trading advisors (“ctas”). Design and build, renovation work. Contract language that allows adjustments to be made to the premium and commission features of a reinsurance treaty.

Understand what is a futures trading and how to transaction takes place through future contract. The future of trading is here. Commodity prices / quotes & commodity charts.

The predetermined price the parties agree to buy and sell the asset for is known as the forward price. I have structured the course for you in such a way that we start with the basics and then move on to the strategy and live trading step by step. The specified time in the future—which is when delivery and payment occur—is known as the delivery date.

futures vs options,futures trading,stock futures,futures

trading for a living sunday night trading futures bonds

trading for a living sunday night trading futures bonds

A Simple Inside Bar Day Trading Strategy Using YM Futures

A Simple Inside Bar Day Trading Strategy Using YM Futures

Automated Trading Services Realities Related To Online

Automated Trading Services Realities Related To Online

What Is Futures Trading and How to Get Started Investment U

What Is Futures Trading and How to Get Started Investment U

Using Leverage for Futures Trading

Using Leverage for Futures Trading

A Basic Emini Future Trading Guide The Trader

A Basic Emini Future Trading Guide The Trader

/close-up-of-abstract-pattern-767984067-5b8830e2c9e77c0050f04f94.jpg) Minimum Capital Required to Start Day Trading Futures

Minimum Capital Required to Start Day Trading Futures

The Ultimate Guide to Futures Trading Jumpstart Trading

The Ultimate Guide to Futures Trading Jumpstart Trading

Futures Trading 101 Symbols, Contract months, Expiration

Futures Trading 101 Symbols, Contract months, Expiration

What is Future Trading History of future market Part 1

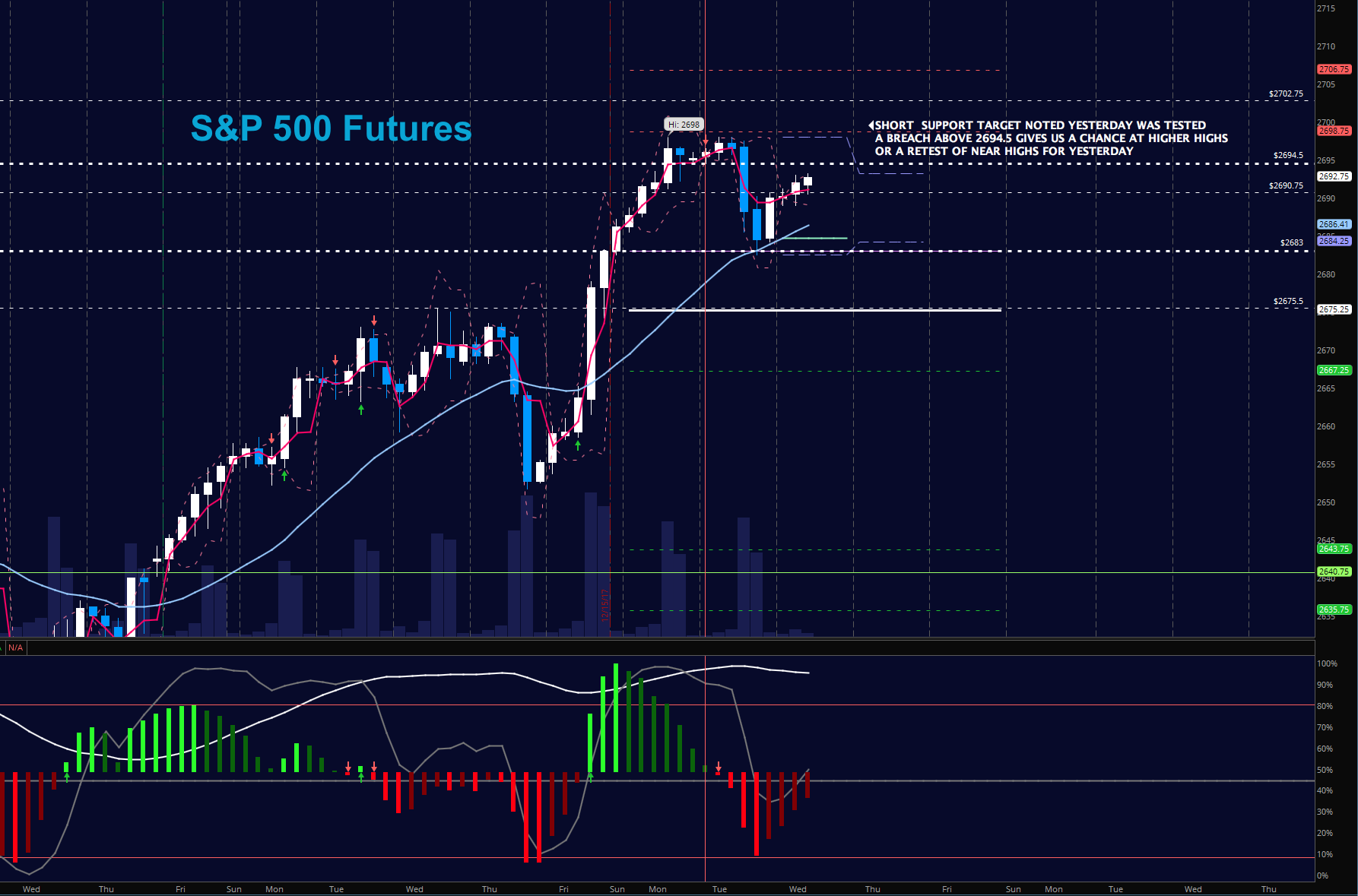

Stock Market Futures Trading Outlook For December 20 See

Stock Market Futures Trading Outlook For December 20 See

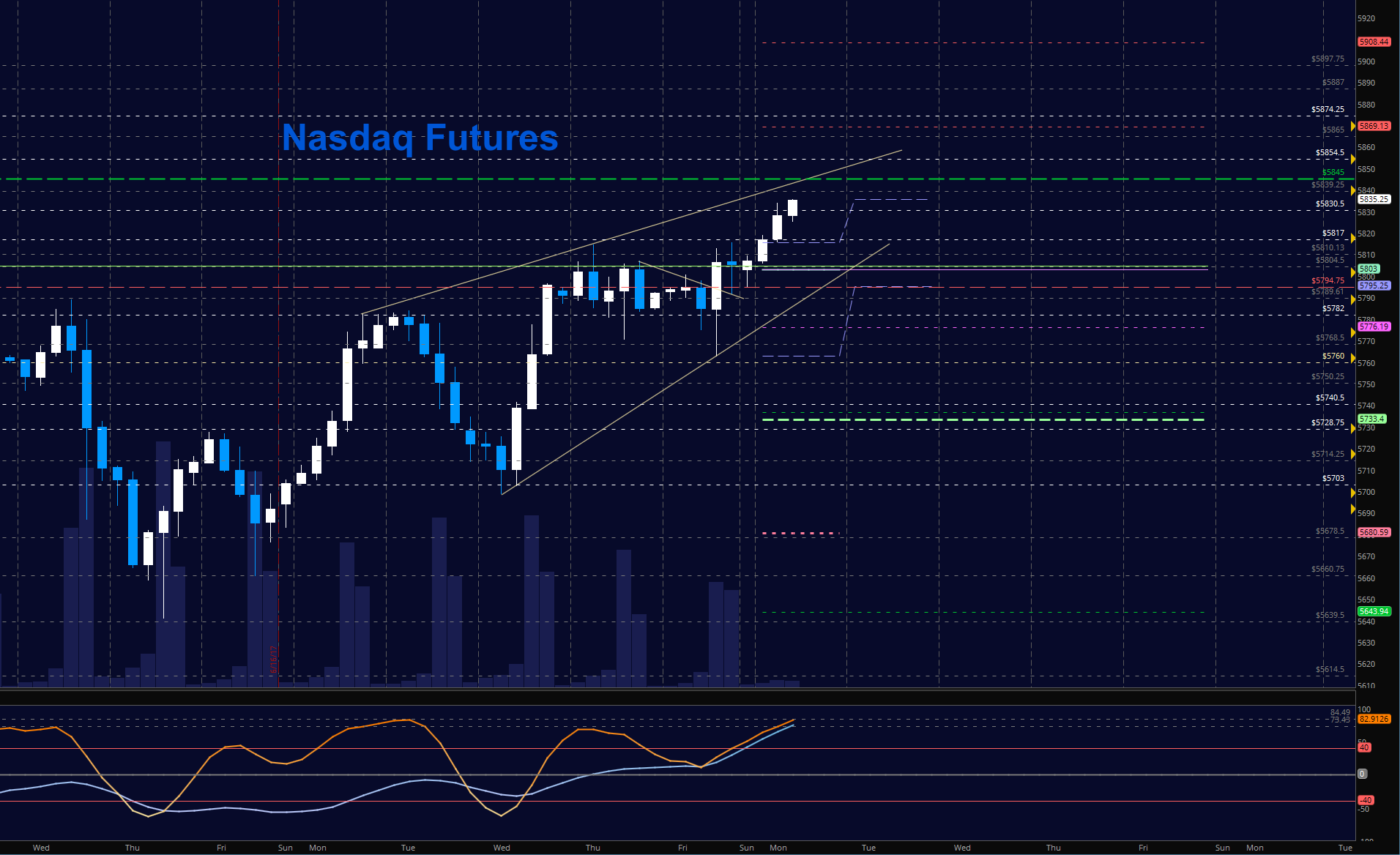

S&P 500 Futures Trading Outlook For June 26, 2017 See It

S&P 500 Futures Trading Outlook For June 26, 2017 See It

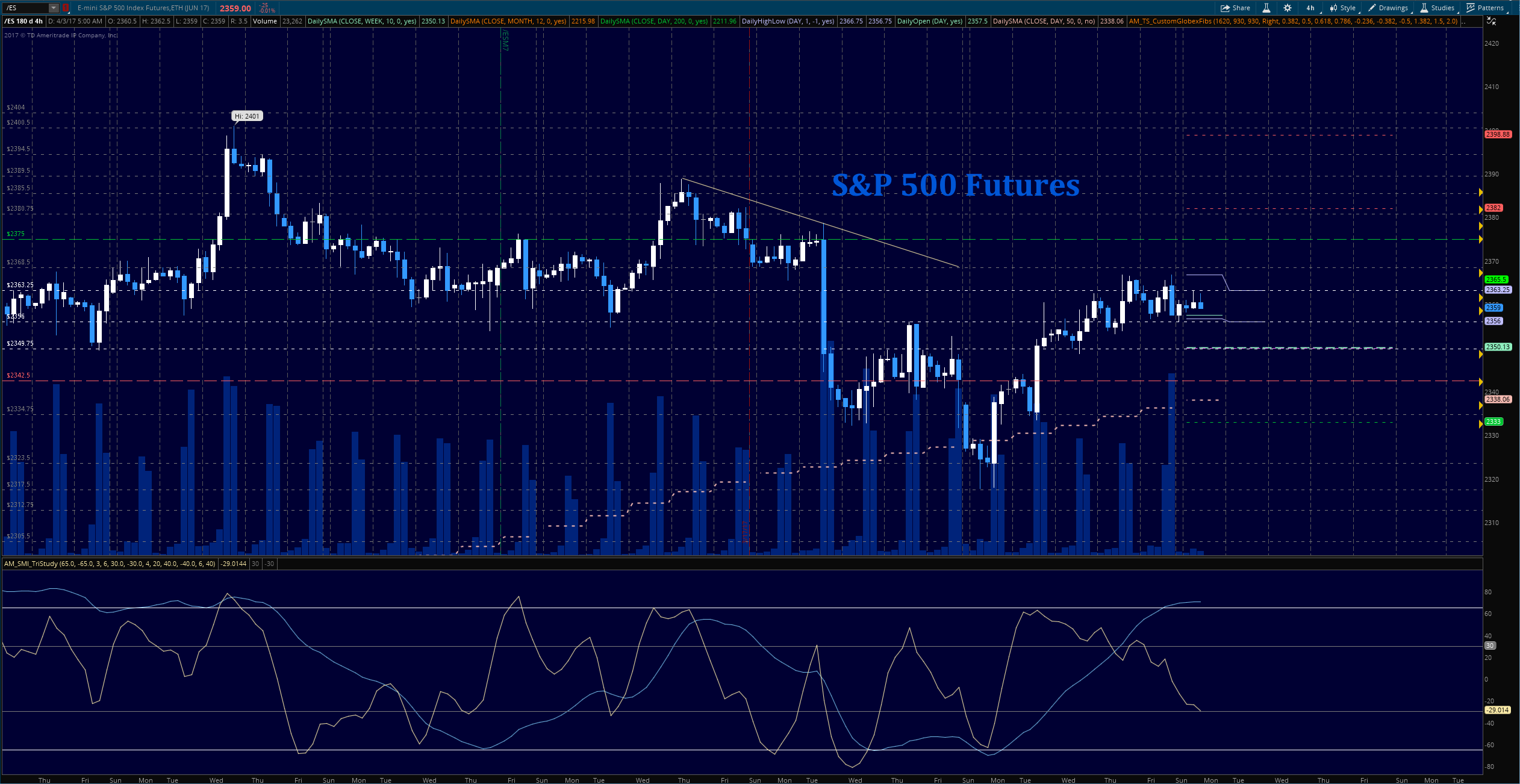

S&P 500 Futures Trading Outlook For April 3 See It Market

S&P 500 Futures Trading Outlook For April 3 See It Market

/close-up-of-man-hand-analyzing-stock-market-chart-1023021802-c3996150b9514293b9bdb1c7e1c11ec7.jpg) Commodity Futures Trading Commission (CFTC)

Commodity Futures Trading Commission (CFTC)

Basics of Futures Trading Explained NeuroStreet Inc.

Basics of Futures Trading Explained NeuroStreet Inc.

S&P 500 Futures Update Identifying Pullback Support

S&P 500 Futures Update Identifying Pullback Support

No comments: